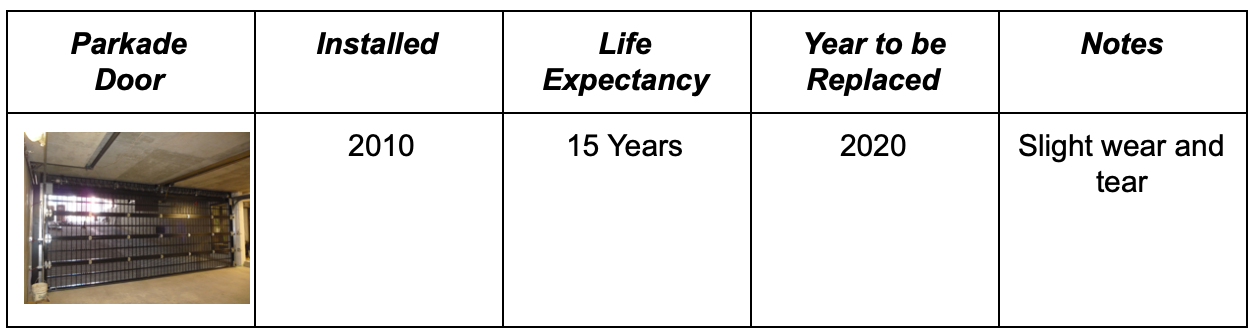

Door controls and motor drive systems for automatic sliding door s and revolving door s incorporating chains controls motors and sensors but excluding door s 10 years 20 00.

Garage door depreciation life.

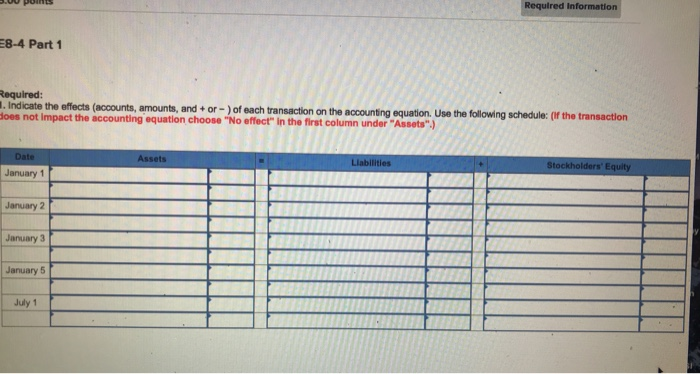

Repair expense or capital improvement.

Depreciation for residential rental property assets.

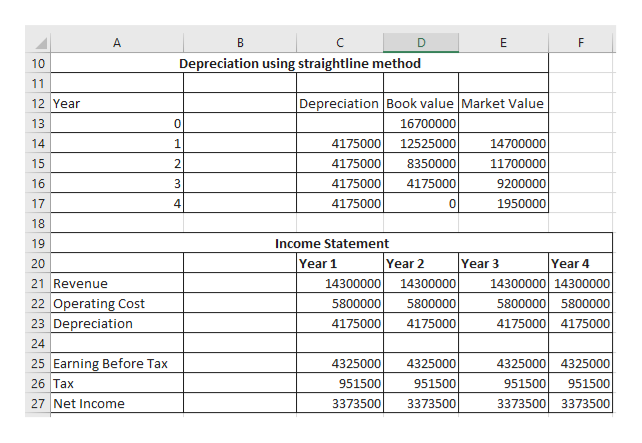

You then deduct the depreciation from income every year of the useful life.

I am of the opinion that is a new capital asset and is normally depreciated over 27 5 years.

If you choose to depreciate the garage door opener select appliances carpet furniture category and the software will use the 5 year class life.

The checklist represents the ato s current views on which assets can be depreciated under division 40 and which assets may be eligible for the building write off under division 43.

To determine yearly depreciation divide the cost of the asset by its useful life.

Repainting the exterior of your residential rental property.

However under new de minimis rules you are able to deduct the entire cost in the year of purchase.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

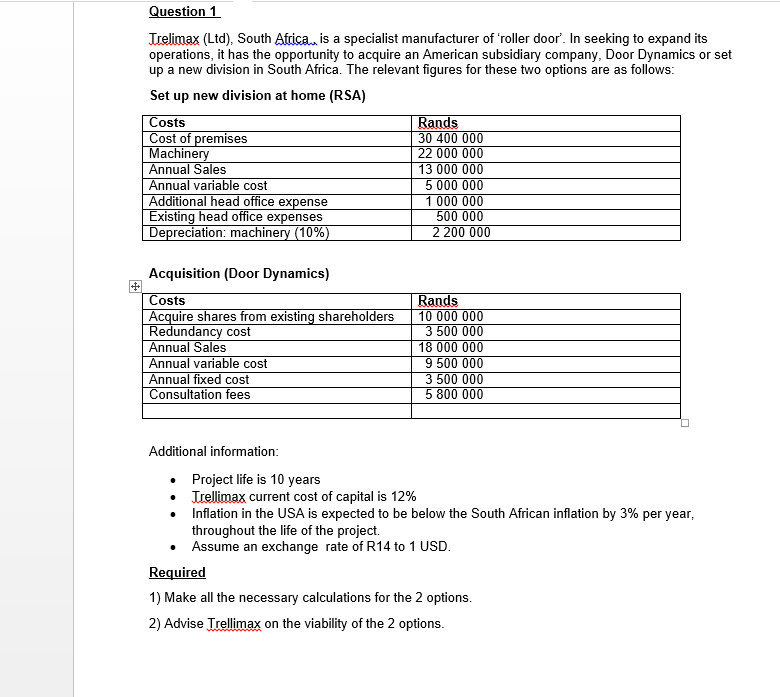

Provides direction to effectively utilize resources in the classification and examination of a taxpayer who is recovering costs through depreciation of tangible property used in the operation of a restaurant business.

The garage door is an integral component of the rental dwelling structure and as such its replacement cost would be depreciated over 27 5 years.

View solution in original post 0.

Rental property garage door replacement.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.

The irs places assets and capital improvements into classes of useful lives.

It also provides the effective life of those assets which may be depreciated.